by IntelliTrans | Feb 5, 2018 | Services

Partnership

Develop relationships. One of the most important things you can do is to build a relationship with your railroad partners. Do the carriers consider you a customer or a partner? Encouraging the rail carriers to view you as a partner is helpful to a successful rail negotiation. From the local freight agent to the yardmaster to the switching crew, the sale representative to the vice president, from the customer service department to the commodity manager, there are many people with whom you should be acquainted. Though many of these positions may have been eliminated, try to maintain those that you can.

A great deal of current and pending regulation constrains the railroads. Determine the ways in which you can help your carrier by backing legislation or initiatives that make sense. Get involved, offer your company’s support. Whatever regulations the railroads face will ultimately affect your company, so the more informed, involved, and supportive you are in the process, the better a partner you will be.

Preparation

Know your freight volumes. Most freight ships under contract rates, but that doesn’t mean that all freight does. If you ship a reasonable amount of volume, it is in your company’s best interest to pursue a contract with your carrier. Even a poorly negotiated contract is typically better than paying tariff rates. If you have enough freight to make a contract negotiation worthwhile, be prepared to invest the time, research, and effort to ensure the negotiation produces the best outcome for your company.

Know your industry. You certainly know your business, and you probably have a pretty good handle on your industry in general, but how do the rail carriers perceive your company as compared to competitors in your industry? Analyze your freight spend, determine patterns of shipments, and understand your private car vs. free runner equation (if applicable).

A common misconception is that rail pricing is a cost-plus strategy. In reality, rail carriers set prices based on the customer’s market health. A great example is the frac sand market. Frac sand is premium sand used in oil/gas drilling. To the carrier, there is no difference in the overhead/cost of moving frac sand vs an equivalent car hauling raw sand, but frac sand rates are 20% to 50% higher because the railroad believes the oil and gas industry can afford to pay the premium.

Know about your competition. Are they rail-served? Where are their facilities located and, if they are rail-served, on which rail carrier? Is it easier for the rail carrier to serve your competitor than to serve your company? What is your competition’s market share? The railroad may be very interested in helping you grow your market share if it directly improves its market share versus their competition.

Know your railroad’s key drivers. Anticipate carrier positions and develop a sound negotiation plan. Know the increase that your carrier plans to seek, and determine what is driving it. Why is the railroad seeking an increase? Is there a new investment or planned upgrade to track or terminal operations that will benefit your company in more expeditiously handling your freight? Is the railroad investing in new equipment that will help your company load/unload more efficiently or that will help improve load factor? Is the increase tied to rising interest rates or other global factors? Is the increase tied to the market, to interest rates, or is there something more involved?

Something often overlooked in a rail bid is the annual escalator in multi-year contracts. We’ve seen multi-year contracts signed with escalators as high as 8%. A $1000 rate with an 8% escalator would increase 36% over a 5-year contract. This compounded increase is frequently overlooked, but negotiating a lower escalator can be one of the best strategies for long-term cost avoidance. Try to negotiate the escalator to be in line with the All-Inclusive Less Fuel Index, which is an index of the rail cost adjustment factor without the influence of fuel cost. This is an industry-standard for measuring rail operating cost adjustments over time (the index has shown an annual increase above 3% in 10 years – typically around 1.5% to 2.5%). In most cases, the escalator is never in line with the actual increases in annual operating cost.

Know when to employ Rule 11. With a thru-rate, the escalator in the contract applies to all segments within the thru-rate. Rule 11 allows the customer to negotiate each segment individually, which allows the customer to negotiate each the rate and escalator with each carrier separately.

While negotiations may seem weighted in favor of the railroad, remember that the rail carriers have massive infrastructures to maintain, fluctuating fuel prices, unions to support, economies of scale to manage, and modal competition to deal with. Like your company, railroads must deliver value to their shareholders and continue to draw investors. Know your carriers’ pain points: labor negotiations, weather and other acts of God, capital expenses, congestion, and a physically constrained network, and government regulations are just a few of their concerns. What amount of resources has the railroad had to commit to PTC (Positive Train Control) and other government mandates? While at historically low levels, the operating ratio of most rail carriers is often higher than in other industries. Rail’s competition is primarily motor carrier, and while the motor carriers do pay highway taxes help to support the highway infrastructure, they have much less overhead allocated to physical plants. Without railroads, competition in other modes would most certainly increase and capacity would not be adequate, driving up prices.

Understand fuel surcharges, accessorial charges, 15-day payment terms, escalators and other factors that affect your total rail spend. You may do a terrific job of negotiating linehaul rates, only to find your company subject to other charges you hadn’t considered as part of the negotiation. This is a commonly overlooked part of a negotiation. Remember that the freight rates should not be the only aspect of the negotiation. In many cases, the contract term, annual escalator, and volume incentives yield better long-term results than the initial base linehaul rate.

It is very challenging (virtually impossible depending on the railroad) to get an established rate lowered. That’s why it is crucial to negotiate the lowest possible rate in the beginning and then work keep the rate low by limiting the escalator.

Know your options. Consider all options, not just freight rates. Are there areas where your company can help the rail carrier? Be willing to offer concessions in exchange for something. Is your company able to pre-block traffic, stagger switch times, eliminate weekend service, or otherwise assist the railroad in cost reduction?

Prepare a written bid package to present to the railroad. Your rail negotiation should be well planned and researched. Know your goals going in; this is not the time to shoot from the hip or to capitulate to general industry averages. Putting a written bid package together forces you to deal with facts and remove emotion. Calculate the railroad’s cost and profit for each of your lanes and educate the railroads when you believe they are not pricing their movements properly or competitively. Know the pivot point for each railroad in your bid evaluation. Negotiate your entire rate structure and not just individual movements—potentially be prepared to give something to gain overall.

Prioritize

Allow enough time, but don’t become overly consumed by the process. You still have day-to-day freight to manage and many other internal responsibilities. Does the tactical suffer at the sake of strategic or does the strategic suffer because of tactical demands? Some companies spend many months in negotiation, only to do it again the following year. It’s helpful to ensure that not all contracts expire at the same time, and expiration dates in the middle of the month are often easier to manage since they don’t conflict with regular month-end reporting. Consider multi-year agreements if you are going to invest a significant amount of time in negotiation. Every hour spent on the process is an hour you don’t have to devote to other things. Many contract negotiations will go several rounds; do not be deterred or lose sight of your goals. IntelliTrans can help manage your daily operations, freeing you up to spend time on strategic matters. Conversely, we can partner with you to manage strategic efforts, including rail rate negotiation, so that you can continue to manage your company’s daily needs.

Predict

Establish a long-term rail transportation strategy. While it may be tempting to award freight strictly on price, remember that partnering with your rail carrier is a way to ensure viable modal competition remains. Where will your company be in five years, 10 years? Be honest about volumes and provide accurate forecasts. How much growth do you anticipate? Can the carrier handle the amount of planned volume increases with the current infrastructure and personnel? Develop a story for why you need a better rate structure to keep rail viable in the long-term. Just as you need to understand the factors driving your carriers’ request for a rate increase, make the case for why your company needs lower rates. What value proposition does your company bring to the table?

Always utilize expert legal counsel for the final transportation contract. As with any contract, be sure to use your company’s legal counsel before signing anything. Negotiation is your job, but the details belong to the attorneys. And, remember, the STB does not get involved in contract disputes but does in tariff disputes.

Quantify

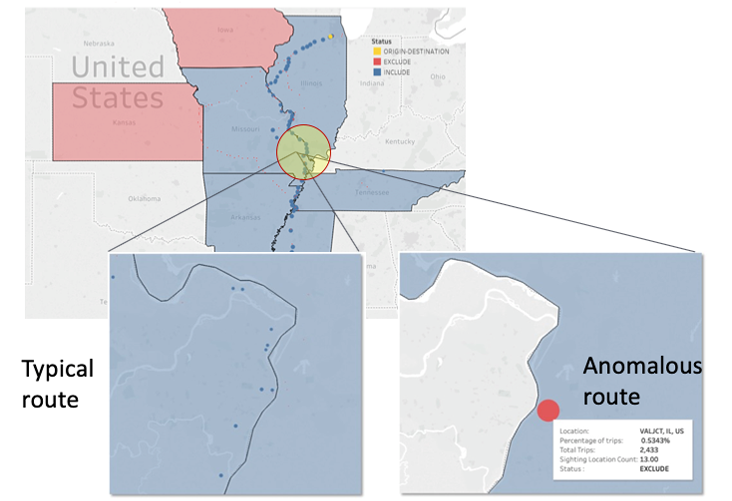

Once your negotiation is complete, continue to benchmark your performance. If having a contract rate in place is important, then so is following the stipulations of that contract. Undertake a thorough examination of tariff rates versus contract rates, as well as how well your company executes those contracts. Is your shipping department using the wrong junction or the wrong type of equipment? You may have negotiated the best rate possible, but if your shipping department doesn’t execute properly, your company has left money on the table and may be subject to unplanned and unnecessary fees and accessorial charges. Internal routing procedures and enforcement are required. Our analytic dashboards make quick work of highlighting discrepancies and outliers.

Questions

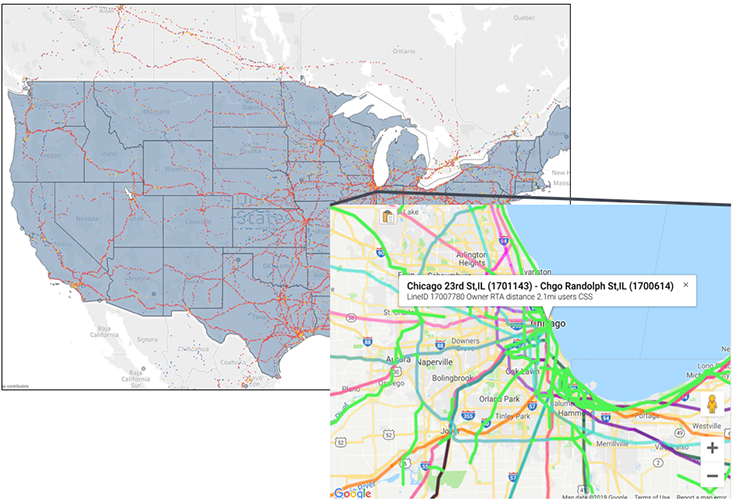

Ask questions; knowledge is power. Arm yourself with a thorough knowledge of rail industry standards regarding haul cost, rates, and agreements. Resources are readily available. IntelliTrans can provide multiple analytical dashboards for use in understanding your baselines, looking at your shipping history and options, as well as running different scenarios to determine your best-case outcomes from negotiations. In addition, our sister company DAT provides rate and capacity information on dry van, flat and reefer trucks for use in modal comparison. The railroads use this information themselves to benchmark their competition so it behooves any savvy negotiator to be operating from the same knowledge set. The amount of information available has never been greater, so equip yourself as well as possible.

Having the ability to undertake a modeling analysis will help you achieve the best possible results, however, day-to-day duties may prevent you from being able to do so. Seek outside guidance where necessary.

IntelliTrans has many years of experience in assisting our customers with rail freight rate analysis, negotiation, and execution. We can share with you the successes we’ve had helping clients of all sizes – from small businesses to Fortune 500 companies. Because we track a very large portion of the North American rail volume each month we have an extraordinary view of the marketplace. Coupled with DAT’s truck rate benchmarking, we have an unprecedented view into areas of opportunity to help you conduct the best possible rail negotiation.

IntelliTrans can provide a cost/benefit statement that will help you easily see the value we bring to your specific situation and share some of our recent success stories with you. Contact us for more information on how we can help you achieve your most successful rail negotiation.